DISCLAIMER: This is an anecdotal description of my experience. I have no qualifications to give advice on legal or tax matters. Also, the circumstances of this transaction were unique, and might not apply to someone else. Most people will do better just getting a lawyer to help.

[If you just want to see what the Deed looks like, skip to the bottom of this post.]

Background

When my father-in-law passed away, he left a plot of land in Hawaii in a trust for my wife and her two sisters.

None of the sisters really wanted the land, and my sisters-in-law said to just take it, but I wanted to give them a fair price. A same-size lot a few blocks away was going for $18k on craigslist, so that became the amount I paid into the trust account. I wrote a couple paragraphs to document what we were doing, and everyone signed. It was an informal paper, not intended to have legal rigor. Just something to be sure we were all on the same page. One thing to note is that there is complete trust and goodwill in the family. I would have no problem giving them that amount as an outright gift. Nor did they have a problem with me taking the land for free. Not all families are copacetic like this, so if yours isn’t, you might want to enlist a professional.

So, I had informally bought the land. How would we transfer the title, legally? A real estate agent would take 10%, and most of their work would be in finding a buyer, which we already had. No thanks. How about a Title Company? They would provide title insurance, which I didn’t really need, as we had all the documentation (including previous title insurance) that said who owned the land. We had been paying property taxes all along, so knew the taxes were current. We didn’t need escrow service, as there was trust within the family. And the fee for title insurance plus escrow was substantial, compared to the price of the land. Finally, the Title company wouldn’t create a new deed for me, I’d still have to pay an attorney. The title company gave me the names of a few real estate lawyers nearby, and I contacted one. For a simple deed, about $500. I’m wary of a lawyer’s estimates, though. Probably, our case was not simple.

About Hawaii’s Recording System

Most states are like California, where land sales are recorded by individual counties. Hawaii is different, in that there is one unified office, the Bureau of Conveyances (BOC) for the entire state. Moreover, a document such as a Deed might be recorded in the Regular System, or Land Court (Torrens system), or in some cases, both. The Regular System, under which most bare lots on the Big Island such as ours are recorded, is less rigorous in its requirements. Land Court is far more picky, I’m told. Had our property been under Land Court, I might not have attempted DIY.

Trying to DIY it

Although the BOC Site was peppered with warnings to use a lawyer, I decided to give it a go on my own. I could at least take it as far as I could go, then pay a lawyer if I got stuck. This would be much simpler if Hawaii had some blank forms to fill in, but there weren’t any. Some websites offered blank Deeds that supposedly would be valid, but I had no idea whether those would work. I decided to copy the language of the existing Deed, making adjustments as necessary. Full disclosure, my cousin is a paralegal, and she looked over my work and gave advice before I submitted everything.

Fortunately, we had a copy of the existing deed, but if we didn’t, the BOC has a nice search facility for recent documents. The physical BOC office also has a research room, where the public can probably do their own searching the old way.

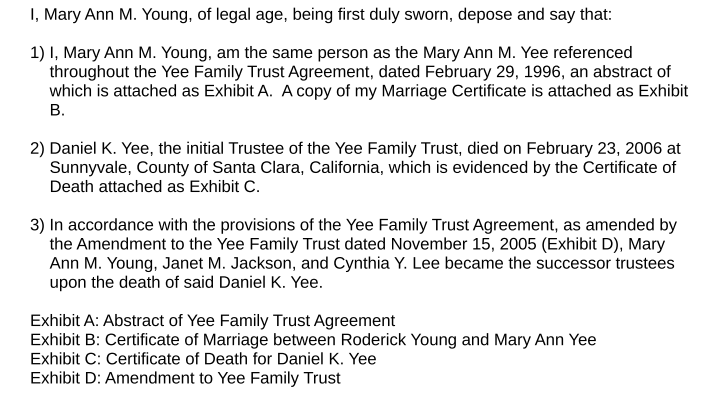

Affidavit

The first thing that jumped out about the existing Deed is that the owner was the Yee Family Trust. To transfer the land, we needed to show that the original Trustee, my father-in-law, had passed away, and that my wife and her sisters were the successor Trustees. The first part was simple, since we had a Death Certificate on hand. All we had to do was blank out the Social Security number on it as required by law. A little piece of sticky note was enough. We had to attach an abstract of the Trust, along with the notarized signatures, and also, an amendment to the trust that my father-in-law had later made, to show who the successors were. The amendment corrected the sisters names to be their married names, except for my wife. So we also included our certified Marriage Certificate as an Exhibit. By the way, all the exhibits must be labeled, even if it is obvious what they are. Handwritten labels are okay.

Here is a link to a somewhat redacted copy of the Affidavit. It’s just two pages: a required cover page, and the affidavit itself. Since we were getting the signature notarized in California, I used the California text for notarizing a Sworn Statement. That wasn’t really necessary, as any notary will provide their own page to certify the signature on such a document.

The Exhibits were attached for filing, but are not shown here.

Deed

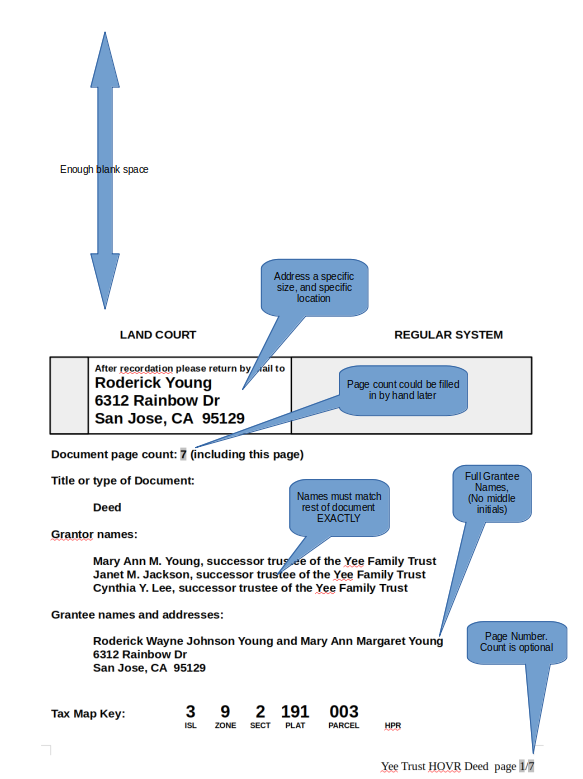

The format of the Deed seems rather flexible. But there are many reasons it could be rejected by the BOC, including simple things like not being on single-sided 8.5″ x 11″ paper. The rejection form gives an idea of the kind of things a document could get bounced for. This page has unofficial copies of the governing documents for recording, among other things. The governing documents aren’t that long, and worth a read.

A cover sheet is required. I made my own, in compliance with the governing document. It had 3.5” of blank space at top. If the document was for Regular System, they would affix a sticker in the top right corner. Land Court, a sticker in the top left. Dual filing, both corners. My return address was 1.5” from left edge, per spec, and no more than 3.5” wide. UPDATE (20-Feb-2020): after seeing the actual envelope that they use to mail back the documents, I think the correct dimensions should be 0.75″ from the left edge, and no more than 2.5″ wide. Those adjustments have been applied to my sample document. I put required information such as Tax Map Key, Grantors, Grantees, Document Type, and Page Count directly into the document, but it would have been acceptable to fill those in by hand.

The title in the footer helps people know that they are signing the same document. Originally, I put a Printing Time and Date in there, too, to assure people that they were signing the same version. I later removed the timestamp, which turned out to be a good move, as the deed needed some changes before it was accepted.

Pages must be numbered. I formatted each page number as “page 1/7” rather than just “page 1.” That gave a bit more assurance that pages had not been added or deleted from the original, but sacrificed the possibility of doing so. The ultimate in flexibility would have been to omit computer-generated page numbers altogether, and hand-number the pages just before filing.

There is a forms page with various forms, including a sample cover sheet. Oddly, their sample doesn’t seem to meet the letter of the specifications set out in the governing document, but it’s guaranteed to work.

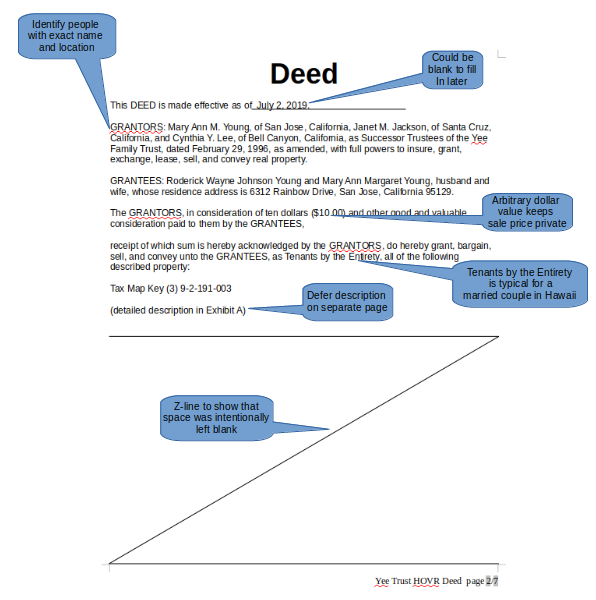

Here is the meat of the Deed, not even one page:

The title of the document is simply “Deed.” Previous instruments said “Grant Deed” or “Transfer Deed.” The original Deed began with “Know all men by these Presents…” Besides being sexist, who talks like that? I would almost prefer “Ma keia palapala, hiki keikeia e na poe a pau (In this document, it can be seen by all people),” which is also hard to understand, but at least inclusive. Nope. Basically, I just identified who was selling, who was buying, and what was sold.

The effective date of the Deed is explicitly called out at the top for convenience, even though it should default to the date of the last signature. Filling in the blank by hand would have been fine, too.

Having lived most of my life in California, my natural inclination would be to specify tenancy as “Joint Tenants” or “Community Property,” but Hawaii is one of those states that has something better: “Tenants by the Entirety.”

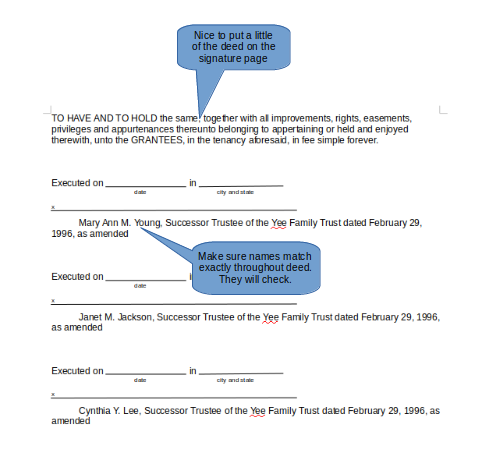

The signatures are on a separate page, even though there would have been room for at least some of them on the first page. The reason is flexibility. If the deed needs to change before filing, the changes can be made, without getting new signatures notarized. I KNOW. I know what you’re thinking. Isn’t a notarized signature kind of worthless if somebody can just change the document later? In practice, people commonly adjust things to meet requirements for filing, and the BOC must be aware that this kind of thing goes on. Later in this article, I discuss how this flexibility saved me.

Notice that the “TO HAVE AND TO HOLD…” is on the signature page, when it could have fit on the first page just fine. This is to provide an air of continuity, suggesting that I didn’t just grab an arbitrary signature page from something else. I put all the signatures on one page to give more assurance that everyone was signing the same thing. It would have been legal, perhaps even easier, for each person to sign their own copy, given that all signatories lived in different cities, and that the filing was in another state. All we would have to do is add a bit of language to the Deed saying that signatures in counterpart are valid. But again, I wanted all original signatures on one physical page.

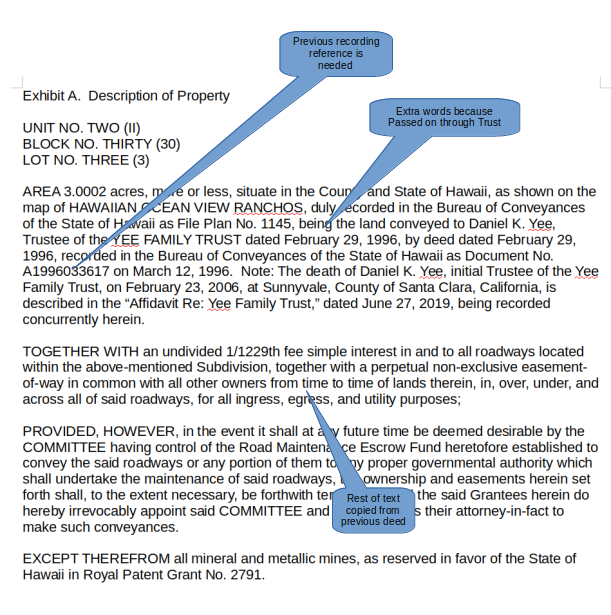

Originally, I had put the whole description of the property directly into the Deed, but my cousin advised pulling it out in to an Exhibit, as was customary. Why, I don’t know.

According to the rules, the description must include a book and page number, or reference to instrument that does. That’s what the A1996033617 is for – it’s the document number for the former Deed.

As a point of interest, the last paragraph just affirms what people generally already know – that ground water, if any, belongs to the State, and you can’t dig your own well.

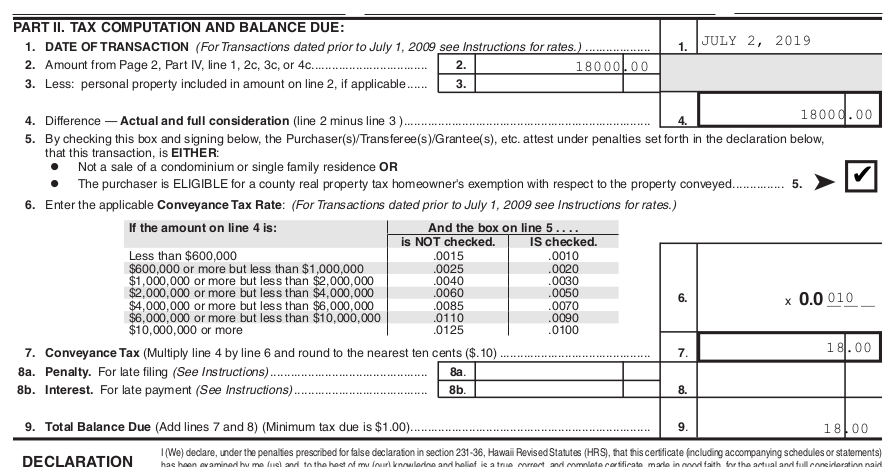

There was one last form to file with a real estate transfer, the mandatory P-64A conveyance tax certificate. A fillable pdf can be found here.

Filing the Documents in Person

In theory, the whole business could be done by mail without ever leaving California. But then, I might have to go back and forth if the document got rejected. But also, if all I got was the rejection form with boxes checked – it might not be clear this this amateur what needed to be fixed. Besides, we were going to Hawaii anyway to visit family.

So my wife and I drove over to the BOC with the Affidavit, Deed, and Conveyance Tax Form in hand. Plus about 25 pounds of backup documentation and ID, just in case.

The BOC opened at 8 am, but people suggested that we avoid opening time, since runners from Title Companies might come over with stacks of documents first thing in the morning. So we went at 11 am. Finding street parking was not an issue at that time on a weekday. It was $1.50 an hour.

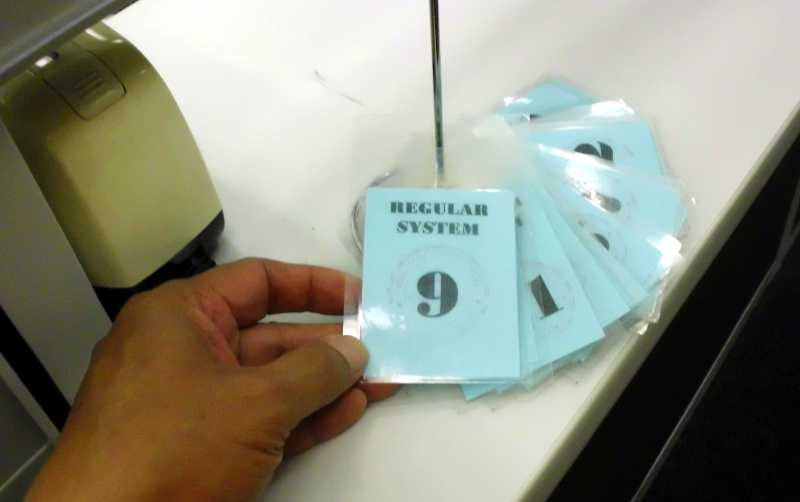

I took a number and sat down. I had brought something to do in case the wait was long, but in less than two minutes, my number was called.

The recording clerk was very nice. Maybe it’s a Hawaii thing, but I find that if I lead with kindness and humility, it tends to be returned. She looked over the documents as I stood there at the window. It was kind of like a building inspection – she seemed to be looking for specific things. She pointed out that each Exhibit attached to the Affidavit needs to be labeled. I pulled out a pen and did so. With that, the Affidavit was ready to go.

On the main page of the deed, I had put lots of aka’s (also known as) for the people, to reduce the chances of title problems later. Instead of just “Roderick W. J. Young,” I put things like “Roderick Wayne Johnson Young aka Roderick Young aka Roderick W. Young aka Rod Young aka Primatologist Young.” This would have been fine, if it was consistent throughout the whole Deed, but the printed name under the notarized signature was just “Roderick W. J. Young.” The clerk explained to me that it doesn’t matter how people sign, but the printed names must be absolutely identical throughout the document. She noted that on a rejection form, and I took the documents back, thanking her.

Not bad for a first try!

There were two ways I could make the names on the Deed consistent. One was to change all the signature lines to include all the aka’s, then send the whole thing around again for everyone to sign and notarize. The other way was to use the existing notarized signatures, and take out all the aka’s in the rest of the Deed. I took the second, more expedient route, of course, and was thankful that the original signatures and notary seals were on separate pages from the body of the Deed. I emailed a copy of the edited Deed around to the sisters to keep things ethical, and they said it was fine.

Two days later, I went back with the revised Deed. The clerk that time looked at the rejection form, and made sure that all the problems were addressed. That part was also like a building inspection – the second inspector just checked the things the first inspector flagged. It was all in order.

Although the governing document said to staple pages at the top left, I used paperclips, in case something needed to be replaced at the last minute. No problem. They had a stapler at the window.

The fee for filing was $41 per document, up to 50 pages. It would have been nice if I could have filed both the Affidavit and Deed together as one document, but the Affidavit needed to be filed first, as it affected the Deed. 2 documents, plus the conveyance tax, $100 even. I wrote a personal check on the spot.

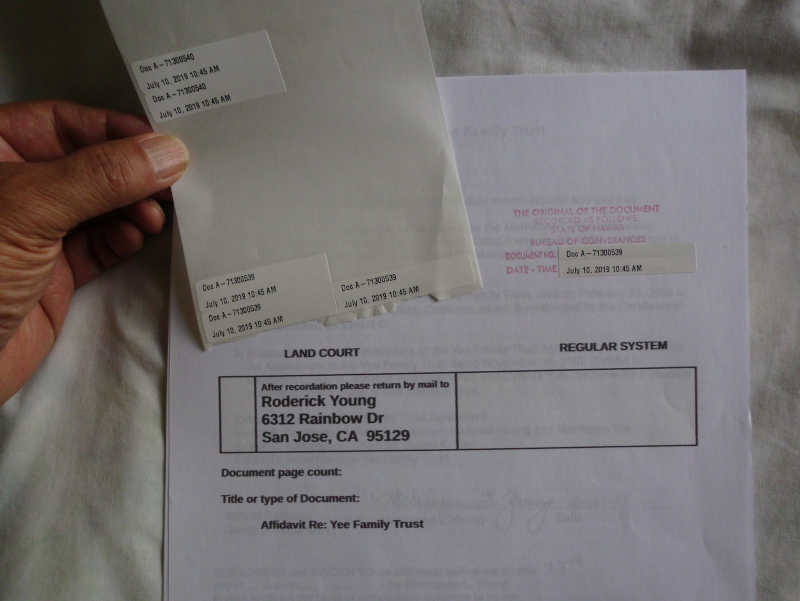

When everything is recorded (it could be months), they will mail the original documents back to me. I had a brought a self-addressed, stamped Priority Mail envelope for that purpose, but the clerk told me that they use their own envelopes and postage.

Here is the (somewhat redacted) Deed (LibreOffice Document). I don’t know why I redacted it, as it’s public record.

Update (20-FEB-2020):

Yesterday, we got the final documents back in the mail from the BOC. It had been more than 7 months since filing. Fortunately, there was no rush. The property tax website was updated much more quickly, by the way.