In this article, I’m collecting mundane tidbits of daily life with the hope that they will be of interest to future generations. My raw journal is in the file, “COVID-19 Reflections” on my Google Drive.

Just after Christmas in 2019, Merrianne and I were touring in New Zealand. We saw news about some virus outbreak in Wuhan, China, but didn’t think much about it. When we got back to the US, there was an outbreak up near Seattle at the start of March. I didn’t think much of that, either, at the time.

In early March, 2020, I had my last in-person lunch with any friend for almost two years. Everyone was talking about what a coming pandemic would mean, and I was concerned about the political ramifications. If the President handled the pandemic well, he could be the Savior of America, and given the public’s short memory, all the things that had happened over the past 3 years would be forgiven.

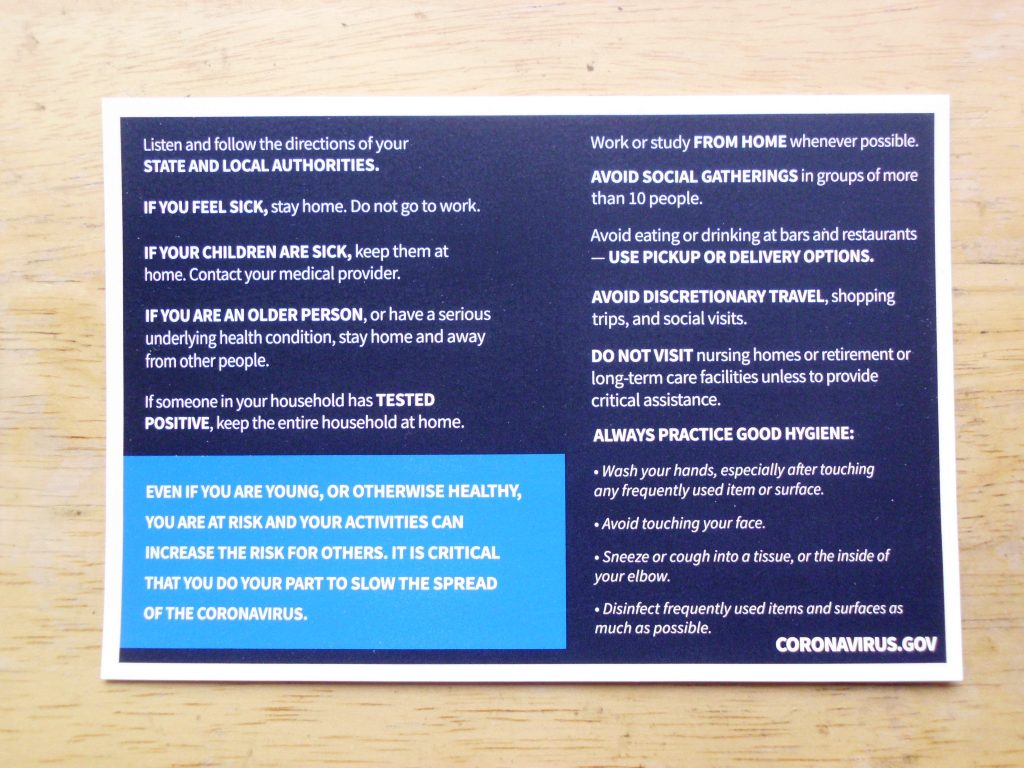

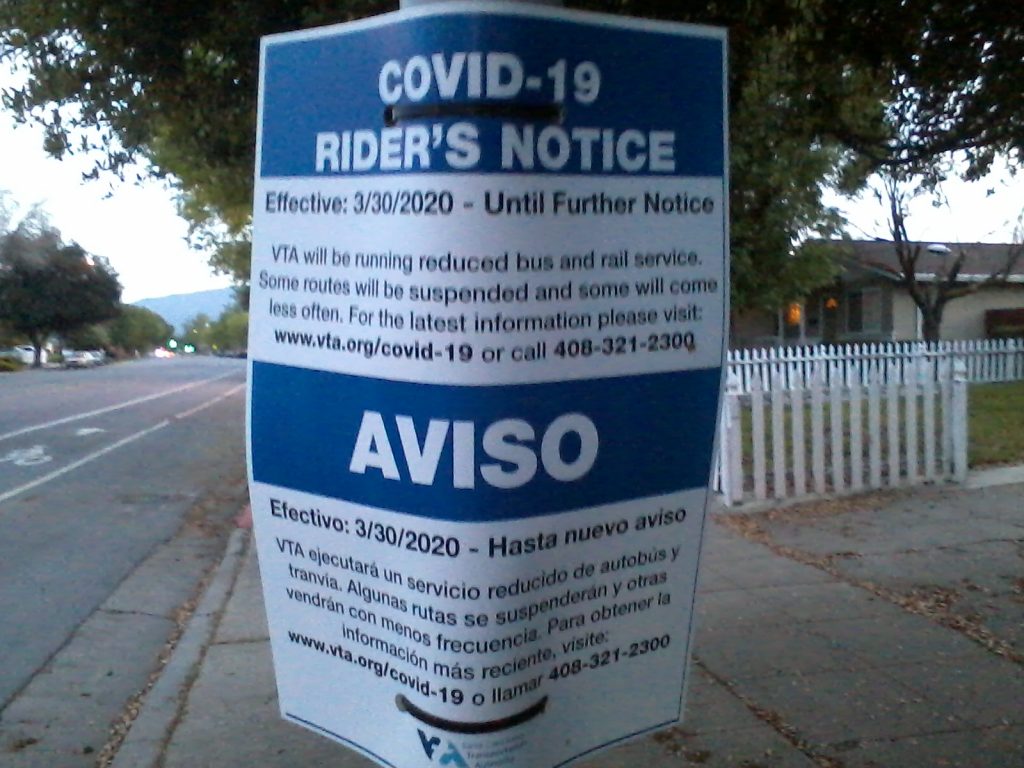

I used to walk daily to the library, to use the internet, and get DVDs. We had perfectly good internet at home, but the library was a more pleasant venue, and somewhat social, too, as during non-school hours, other people my age were on the stations. We had streaming services at home, but usually, the good stuff would be available for checkout on DVD before it reached free streaming. Libraries stayed open until about the third week of March, but I stopped going, out of a preponderance of caution. Nobody knew how contagious the virus was, nor the likelihood of contracting it via touching a shared surface or object, nor breathing the same air as someone else either indoors or out. We didn’t know how effective masks were. We weren’t even sure how long the virus stayed active outside the body. We just didn’t know.

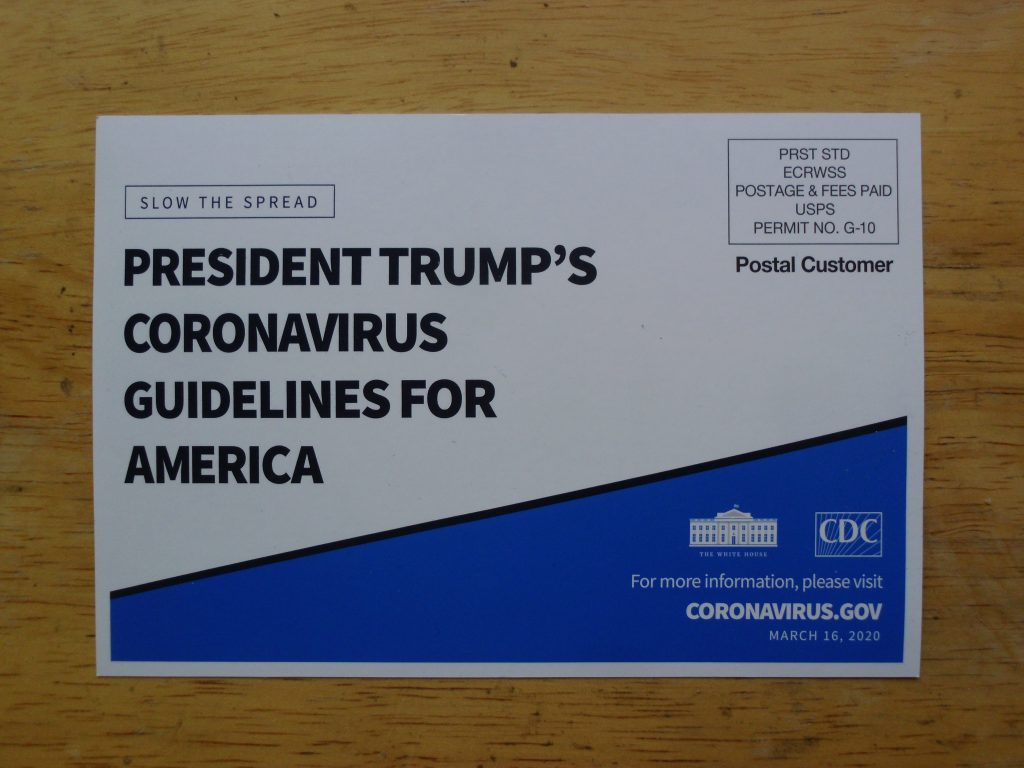

I believe the scientific community wanted to call the pandemic SARS-CoV2, but there had been a SARS before, so no one seemed to use that term. Then-President Trump called it the “Chinese Flu” or “Kung Flu,” but that was considered racist and improper by many in my circle. I never saw terms like that used in mainstream news. Early in 2020, I heard people commonly say “coronavirus,” but that died out, probably because it had too many syllables. Most people called it Covid-19, or simply Covid. When there were major variants, some thought they might be dubbed Covid-20 or Covid-21, but that never happened. Online, a few called it the ‘Rona.

Cruise ships didn’t shut down for some time. I wasn’t paying attention much, because I wasn’t planning on taking a cruise, but marveled at why anyone would want to go at such a time.

Public bathrooms were closed in most places. I was following blogs of cyclists on the Pacific Coast Trail, and one reported campsite bathrooms closed due to lack of toilet paper. By April, virtually everyone doing a bike tour canceled and made emergency arrangements to go home. Those in foreign countries were sometimes stuck in whatever city they were in, for a 2 week quarantine.

Early on, it was thought that young people were resistant. People remarked that none of the deaths seemed to be children. I think that was true, but it fueled complacency among some of the younger generation, who thought they would be resistant, if not immune. College students still went to beaches on spring break. The problem with that was that it allowed the virus to spread wildly, including to the more vulnerable. And as large un-vaccinated populations held the virus, there was more chance for mutation into worse variants. Two of my friends’ parents were killed by covid-19. Both were in their 80’s. I knew some younger people who didn’t die, but had long-lasting symptoms. The grand-daughter of a friend, a teen who was already diabetic, was hospitalized. A distant friend in her 50’s was in the hospital for more than a month, on a ventilator, but recovered with lingering symptoms.

The official shelter-in-place started on March 17, 2020. Most churches stopped meeting at that time, with just a few defiant, even when bans against meeting became formal. North Valley Baptist was one of those. I thought it was a poor witness, personally, and was surprised that so many Evangelical Christians were acting contrary to what I thought was an outstanding opportunity to demonstrate care for the community through personal sacrifice.

The stock market took a dive right around lockdown time. There were complaints that some members of congress and other insiders had divested shortly before that. My Facebook friend Matthew Beggarly told us all not to panic and sell anything. I had an exception. I wanted to recharacterize a some shares from my Traditional IRA to a Roth, and it was a chance to get more of it over. The market zoomed up and up within weeks, burning anyone who got out and didn’t get back in.

Then-president Trump tried to minimize pandemic, and moreover, gave bad advice. The April 4th, 2020 entry from my journal: CDC changed its stance on everyone wearing masks. It now recommends masks for everyone, but says to reserve medical-grade masks for professionals. I think that’s going to encourage the selfish to hoard medical-grade masks, as they will be perceived (probably rightly so) as better. I’m not watching the daily Trump updates, but saw a clip of him passing on the new CDC guideline about masks, then quickly following up with emphasis that “This is VOLUNTARY; you don’t have to do it. I don’t think I’ll be doing it.” For the rest of the year, he would continue to say things that I thought would actually encourage the spread of disease and increase the death toll. It was infuriating.

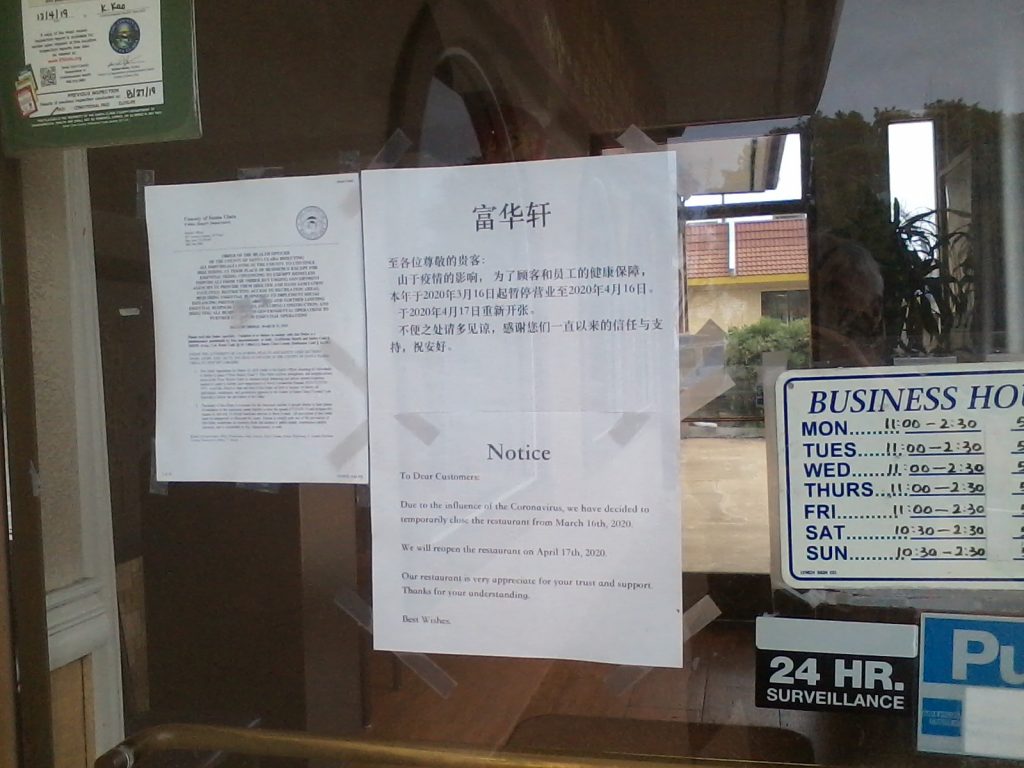

Self-serve vanished at all restaurants, sit-down and fast food alike. Costco no longer had ketchup and relish outside, you had to ask them for it. Similarly, at McDonald’s, there was no ketchup pump for customers, only packets handed out at the register. The basic paradigm of self-serve buffets was destroyed. Around May, 2020, Soup Plantation / Sweet Tomatoes salad bar closed forever. It seemed that all buffets went out of business. At Ranch 99, you could no longer fill your own box for takeout.

Test and Vaccine Centers

I took my first test near May 15, 2020. I don’t have the exact date, because it wasn’t noted on the test result. I wasn’t feeling sick or anything, it’s just that free tests were offered by Project Baseline. I drove through this large indoor building, like a giant garage. A gowned and gloved nurse handed me a plastic bag with the test kit, and instructed me on how to swab the inside of my own nose, then break off the swab in the test bottle and seal it. At no time did we make physical contact. The test was negative.

I signed up as contact tracer. I was not chosen for that, but was asked if I wanted to volunteer at County Test Centers. Certainly! People called me brave, but I had less to lose than someone younger. From July 7, 2020 through February 2022, I actually had more social contact than normal. I loved it! If space was available, I’d sign up for 3, sometimes 4 days a week.

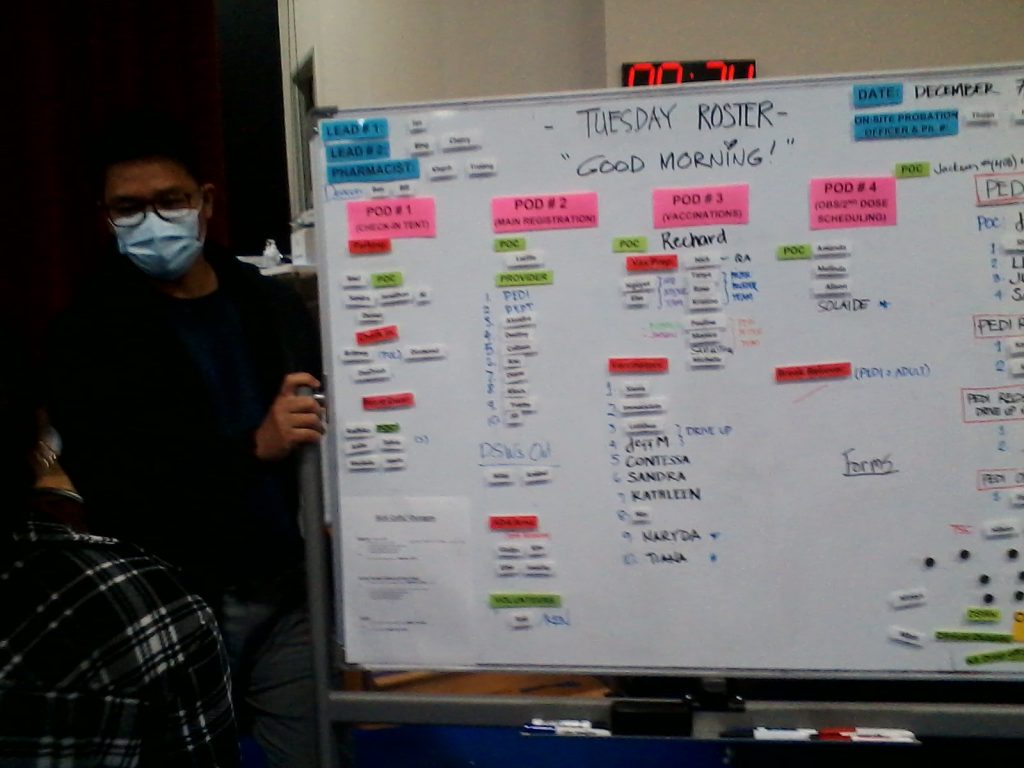

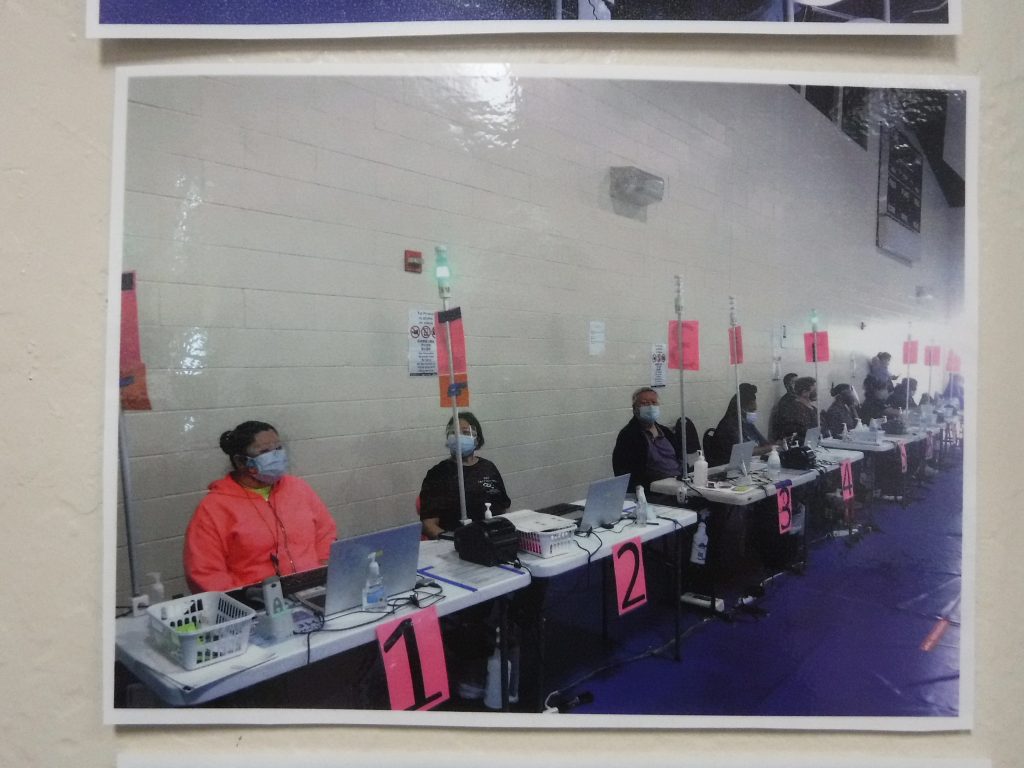

There were several kinds of co-workers staffing the Test Centers:

- Regular nurses and pharmacists from local hospitals and clinics. These were usually the leads or directors.

- Contract traveling nurses from literally around the world. We had some from Uganda, the UK, and the Philippines, not to mention other parts of the USA. Our county was wealthy, so could out-bid other geographies. An RN could get $22k / month working at our test center, which was the size of a mortgage for one of our nurses from central Mississippi.

- Contractors from Filco, a company that normally sets up events. Most of those people were fluent in Spanish, a great asset in East San Jose.

- Diaster Service Workers (DSW’s), county deputies, librarians, buliding inspectors, and so forth that had been activated off their regular jobs to help.

- The National Guard were deployed to help, some from other states. All of them seemed to be medics, qualified to formulate and administer vaccines.

- Volunteers. We had the young volunteers, usually students in a gap year applying to medical school. Two that I knew got in, and left us after the summer to start their term. One was already a medical student in (ironically) Wuhan, and was stuck in the USA until borders opened up. His Mandarin was extremely useful. He also spoke Cantonese, and good English. Then there were older volunteers. Many were retired from the tech industry like myself. I was working alongside former CEO’s and product Architects. Some others were retired doctors, who still had active certification, but were volunteering as non-clinical.

For the first eight months I volunteered, we only did testing. Initially, all the nose swabs were done by nurses. The samples were then sent down to Southern California for analysis at a lab, there. Towards the end of the 2020, we slowly started a pilot using saliva (patient drools into a tube) samples that patients collected themselves. When that was validated, saliva became standard, and we only took nose swabs when there was medical need. This initially saved money, as it cost some $80 to process the nose swab, compared to $3 for saliva. Also, the nurses didn’t have to keep changing gloves after each patient, so it was more convenient for staff. After a few months, Santa Clara County opened its own test lab nearby, and the cost for nose swab and saliva became equal. We switched back to nose swabs at that point. We actually got faster throughput with swabbing, allowing us to handle the busy days of more than 1000 patients.

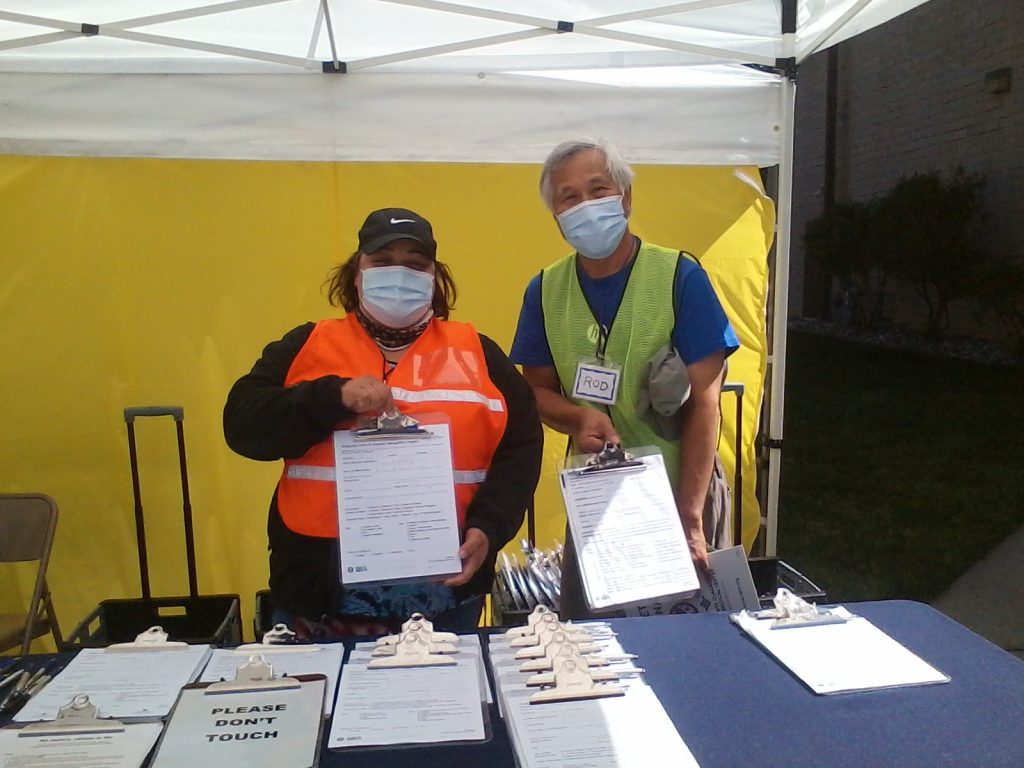

For the first few months, we used plastic clipboards as backing for the forms, so people could have something to write on. People getting tested would fill out a paper form (in order of popularity: English, Spanish, Vietnamese, Chinese), then return the clipboard to a plastic bin. The pen was theirs to keep, although some returned that, too. One of our jobs as volunteers was to disinfect the clipboards. We wore gloves, and sprayed them with 0.5% hydrogen peroxide solution. There was no guideline for how long to soak, but the toughest virus on the bottle said 10 minutes, so we used that. Remember, NO ONE KNEW whether the virus was transmitted by touch, so we wore gloves at all times when passing out forms, and masks and face shields. We were just making things up as we went along. Later, when data showed that the virus was mainly transmitted by respiratory droplets, we backed off to just surgical masks.

Procedures were constantly changing, and outside of basic medical safety and HIPAA protection, we were free to improve things as we went. At first, we had data entry people transcribing the paper forms into computers, but later, patients could pre-register online, saving a lot of typing.

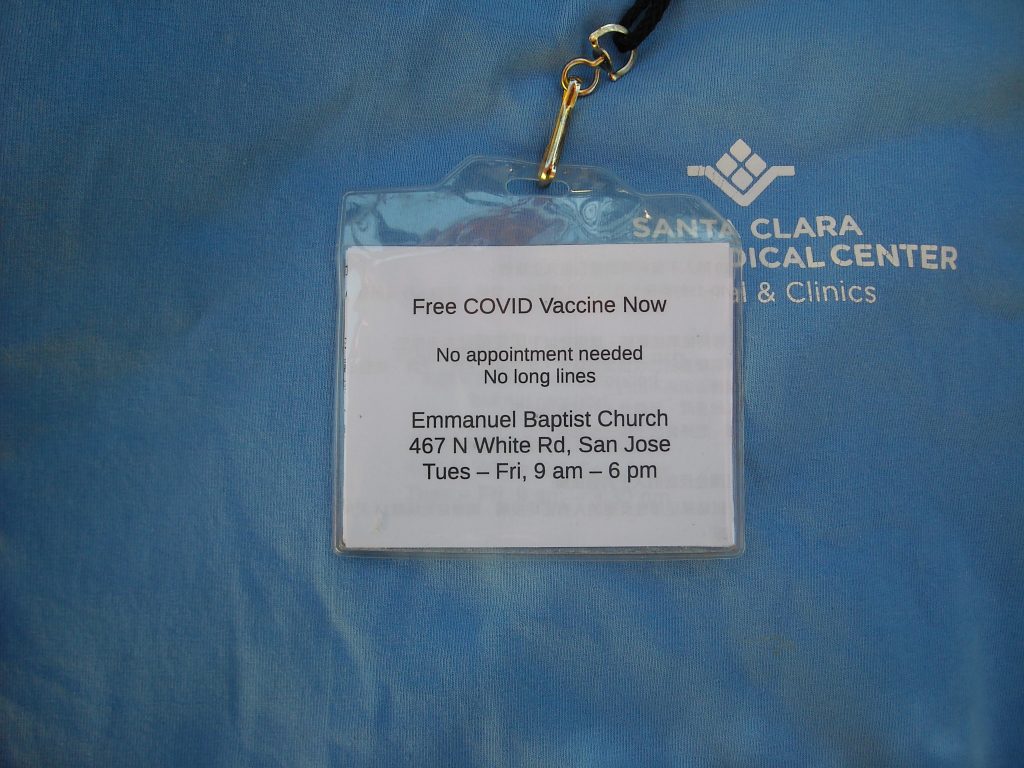

Many of the sites I worked at were pop-up, non-appointment, meaning long lines for first-come, first-served. We eventually went to a wristband system, where people would come to the site to pick up a wristband for a certain hour, then come back later. Some sites went to appointments, but places such as Overfelt High and Emmanuel Baptist Church maintained their walk-in paradigm, to serve those who might not have internet or phone access. At some sites, patients had to stand in line for 2 hours in hot sun. We let the truly needy (like the infirm and disabled) bypass the line, but there was also those who tried to bargain their way to the front without valid reason. Occasionally, there were flaring tempers. I started the practice of delivering free bottled water to the line, which helped a lot in calming people down.

The quoted processing time for tests was up to 3 days, but there was a reagent shortage for a few weeks, limiting the number of tests we could process. For that period, it sometimes took up to a week to get results. Other than that, our turnaround was pretty much 24 hours, although we continued to say up to 3 days.

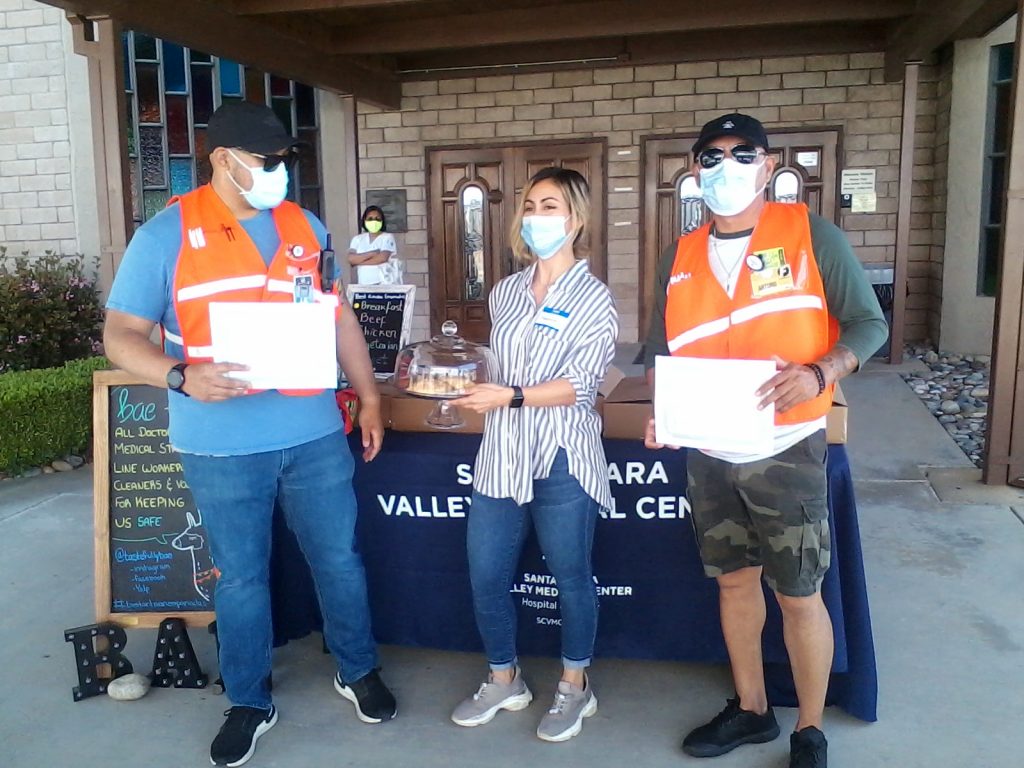

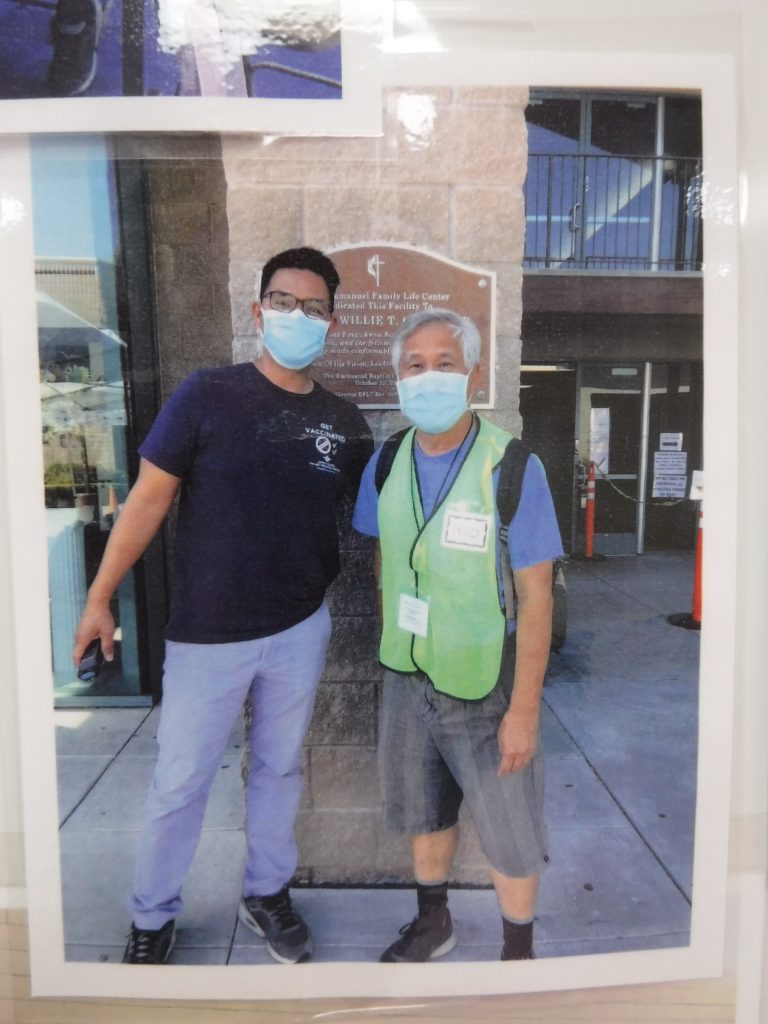

I didn’t take any pictures of the early test sites. It was against HIPPA policy to take pictures with any patients showing. Later pictures were either only of workers, or pictures of authorized pictures posted on the wall. On occasion, we even had news crews filming, with express permission from the County. There was always the County liaison on site when such crews were present.

We often made exceptions to policy when someone really needed it. For example, we were supposed to test asymptomatic patients only, as we were an indoor (gym) facility, but when someone got dropped off with a cough, rather than deny them a test, we filled out all the paperwork outside the building, then had a gowned nurse come out and swab just that person, rather than having them enter. That later became policy, and we would have one or two nurses stationed outside for just that purpose. As long as it was safe, policy had the flexibility to evolve.

We once spent half the day straightening out test results for a woman whose mother was going back to Nicaragua. It was not a frequent flight (only 2 of them per month), so she couldn’t wait another day. When it finally got resolved, she asked, “What time do you eat lunch?” We said various staggered times, as we had to keep the center continuously running. The next day, there was a big tray of pupusas in the break room.

2020 was a Presidential Election Year. Trump had been a horribly polarizing influence on our country for the past 3+ years. He just seemed to have no consistent ethics, morals, nor empathy. I had worried earlier that the Pandemic would be his chance to rally and get re-elected, if he handled it well. He didn’t. He tried to minimize the seriousness of the pandemic, opposing lockdowns, masking, and hygiene measures. He even supported unproven treatments. In the fall, I asked my co-volunteer Lucy whether she was going to watch the Presidential Debate. She said, “No, Trump just makes my blood BOIL.” I knew exactly what she was talking about.

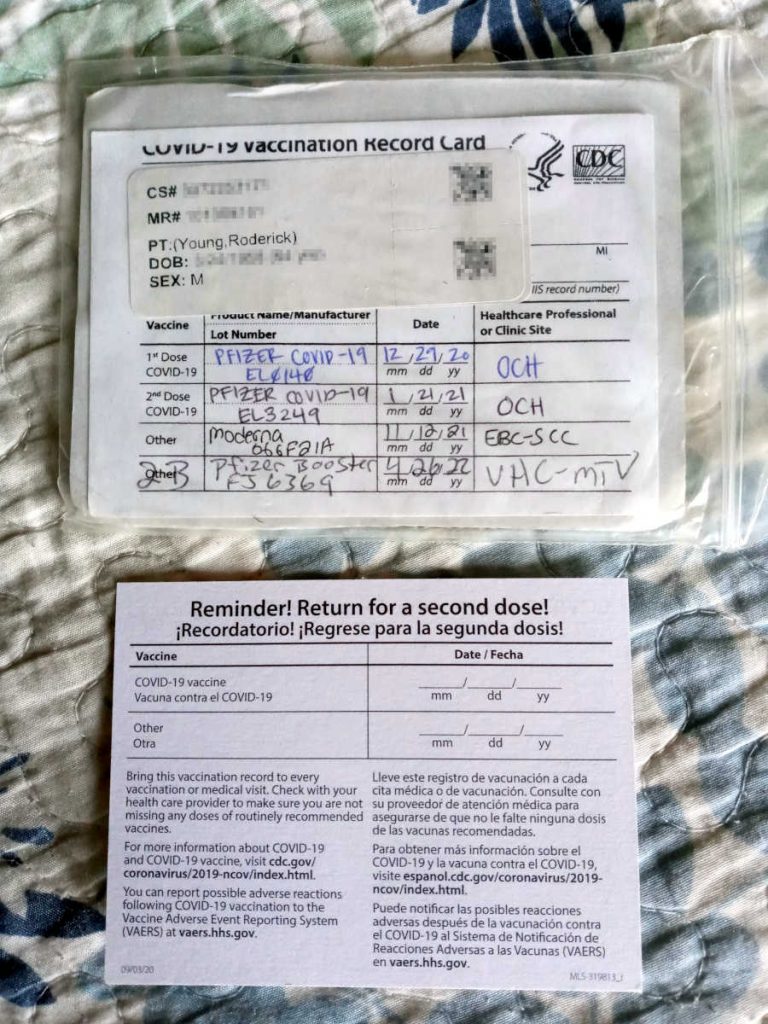

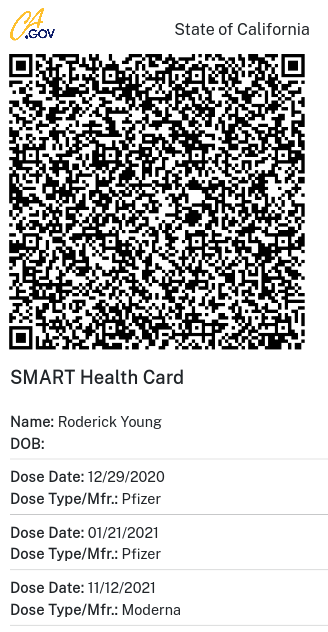

In late December, 2020, the Pfizer mRNA vaccine got its emergency authorization. I was surprised to find that I was classified as group 1a, and initially thought I had mistakenly been grouped in with the doctors and nurses. I wrestled with whether I should accept the vaccine or wait, as it was in short supply, and there was probably someone more deserving. Merrianne said that I should take it. So, at the very end of 2020, I went to O’Connor Hospital and got vaccinated alongside actual doctors and nurses.

On January 6, 2021, while working at the Emmanuel Baptist test center, one of my co-workers Arturo told me that people were rioting at the capital. “You mean protesting,” I corrected him. “No, rioting,” he confirmed. We saw only about half the people show up for tests the next day. Possibly people were afraid of violence in the streets, fortunately never materialized at the test center.

There was a rush of people who wanted vaccine early in 2021. At the test center, we heard that there were supposed to be a national stockpile of vaccine, but that half of it was being witheld for 2nd doses. Then we discovered that there was no stockpile. At one point, San Francisco General Hospital was supposedly promised 20k doses, and only got 1.8k. Kaiser was starved for vaccine. Around mid-January, Santa Clara County started vaccinating at the Fairgrounds. By the time I volunteered there on January 18, we were open to group 1b – 75 years of age and up. Many of those patients were brought in by their children or grandchildren, and many were not computer literate, so needed lots of help with registration and scheduling.

Initially, there was no choosing. It was Pfizer, take it or leave it. Or whatever we had on hand. Appointments were needed; there was no walk-up. Requirements were strictly enforced. I saw people turned away because their stated age didn’t match their ID, or because the address on their ID wasn’t in Santa Clara County. Each vial of vaccine constituted about 8-10 doses when thawed, so it usually didn’t come out exactly even at the end of the day. People waited around at closing to see if they might get any leftover doses , but were informed at we were a zero-waste site, and that any unused doses would be couriered to another site with a later closing time. At one point, we started offering the leftover doses to any staff (including volunteers) on site that had not yet been vaccinated.

Although these were not the very first guidelines, here are some Early-Eligibility-Guidelines that we used in 2021. At first, only Medical Workers and First Responders in Santa Clara County were eligible. The next big category was people who were 65 years or older, or the immunocompromised. Then front-line workers, including teachers, food service, groceries. After the first 4 months things loosened up, and by end of summer, we would do pretty much anyone with a pulse.

I had difficulty volunteering in February 2021. When word got out that volunteers could get vaccinated, the signups were quickly swamped. It reminded me of The Little Red Hen. Where had all these people been for the past year? Official policy was that people were supposed to volunteer for 3 times in order to get vaccinated. One volunteer I saw get vaccinated on her first shift. I never saw her, again. A new policy was put in place for Emmanuel – seasoned volunteers like Halley, Randy, Lucy, Anna, My, and Muoi need not sign up. They needed us to pair with new volunteers.

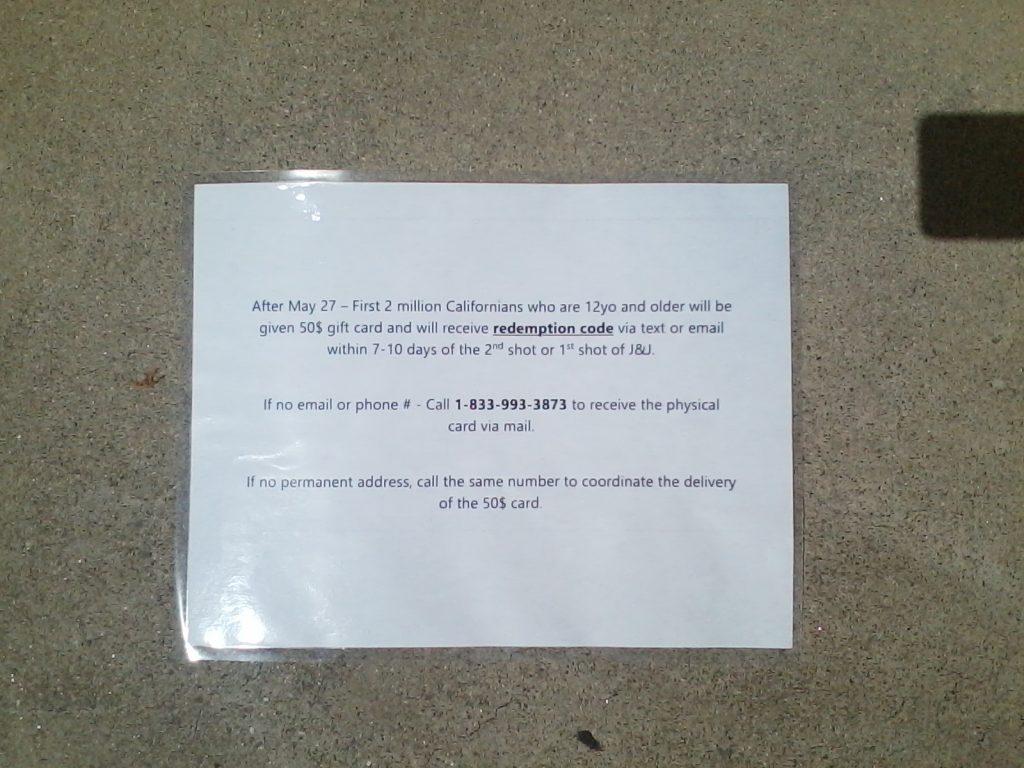

When we started vaccinating at Emmanuel Baptist, initially, it was simply first-come, first-serve. As far as I know, we were the only non-appointment site in the County at the time. When word got out over the next two days, there were huge lines before opening time. We went to wristbands in the morning to allocate spots, then went to appointment-only. One thing that I noticed was that there was always room for exceptions for those truly in need. Our director, Ian, was compassionate. Our mission was to help people, not to find ways to turn them away. As Vaccine supply loosened up, we started taking walk-ins again. As long as someone met clinical requirements, we’d vaccinate them. We took insurance information, but did not require it. One did not need to be a citizen – in fact, I processed quite a few with foreign passports or national ID. For some reason, Mexicans seemed to favor the Johnson and Johnson (Janssen) vaccine, dubbed the “one and done” at the time. For that matter, we didn’t absolutely require ID, or even an address. We vaccinated some unhoused people. At one point, we even started paying a bounty of $50 to people to get vaccinated, plus an entry into a special lottery. West Virginia gave $100 savings bonds, and other states had their particular bonuses.

Not every County site took volunteers, but it seemed that the greatest need was in East San Jose, so I kept signing up there. Most of my time was spent at Emmanuel Baptist Church, where we did up to 1500 people a day. At its peak, Levi Stadium did 10 times that volume.

Lumber prices went crazy in 2021. In Spring, a 4×8 foot sheet of 7/16″ OSB was $81 at Home Depot. Outrageous! That was about 4 times the pre-pandemic price. It was actually cheaper to get a 3/4″ 4×8 of Birch plywood. Blame went to the mills shutting down, as well as shortage of the glue used for plywood from petrochemical plant shutdowns. By the end of the year, that same sheet of OSB was down to about $20, the expected price.

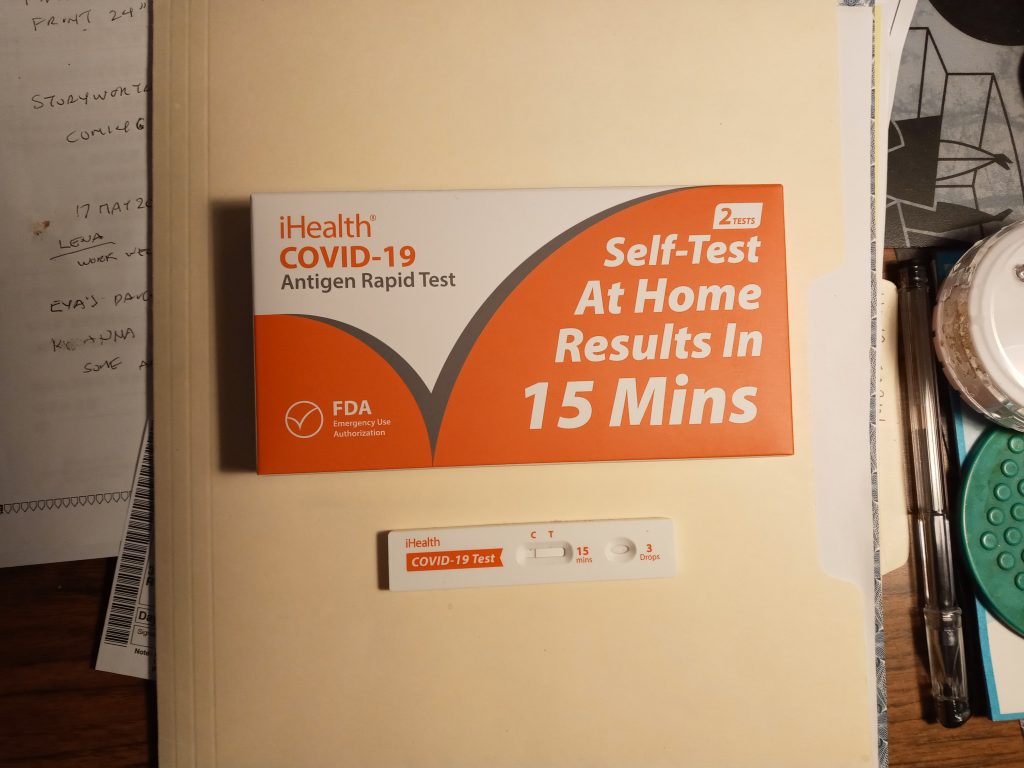

Just after Christmas at the end of 2021, our family went to a cabin in Tahoe with Merrianne’s sisters and their families. It was blizzard weather, so we pretty much stayed inside, unmasked. Most, if not all, of us were fully vaccinated. As we were heading back from the trip, Kendra had a bad cough, and stayed in the car, even when we stopped for pizza. We did not have home tests on hand at the time, but Elliot’s friend gave him a couple. She was Positive. The families of sisters got it, too. Merrianne got it. It was very hard to get free PCR tests from the county, as everyone seemed to be getting it. I could probably have used my connections to get a test at Mountain View, but registered like any other person for a test, and took an appointment at Gilroy. I was Negative. Eventually, everyone in our family got it except me. I bought more tests from Amazon at about $10 per box of 2. They were hard to find in stores, since everyone was getting sick and wanted tests. A few weeks later, all Americans could get 4 free home tests shipped to them.

Coming Out (?) of the Pandemic

In the summer of 2021, as vaccination became commonplace, people began to relax and travel again. Rental car companies, who had sold off large portions of their fleet the year before, were caught short-handed. I heard of someone paying $2000 for a one-week rental on Maui. Some people went to sharing sites to try to find cars. There was also a shortage of new cars, due to unavailability of certain computer chips that went into them. That doubled the prices on used cars.

Towards the end of 2021, restrictions eased in California. And as people went back to work, a strange thing happened. First of all, employees that were allowed to work from home under emergency conditions found that they really liked it, and it was hard to get them back into the office. Second, after being propped up by an eviction moratorium and pandemic relief checks, people realized that they didn’t have to stay in difficult work environments. Lots of people left their jobs, in what was called The Great Resignation. It was hard for companies to find low-wage workers. In the tech industry, salaries zoomed in an attempt to retain talent.

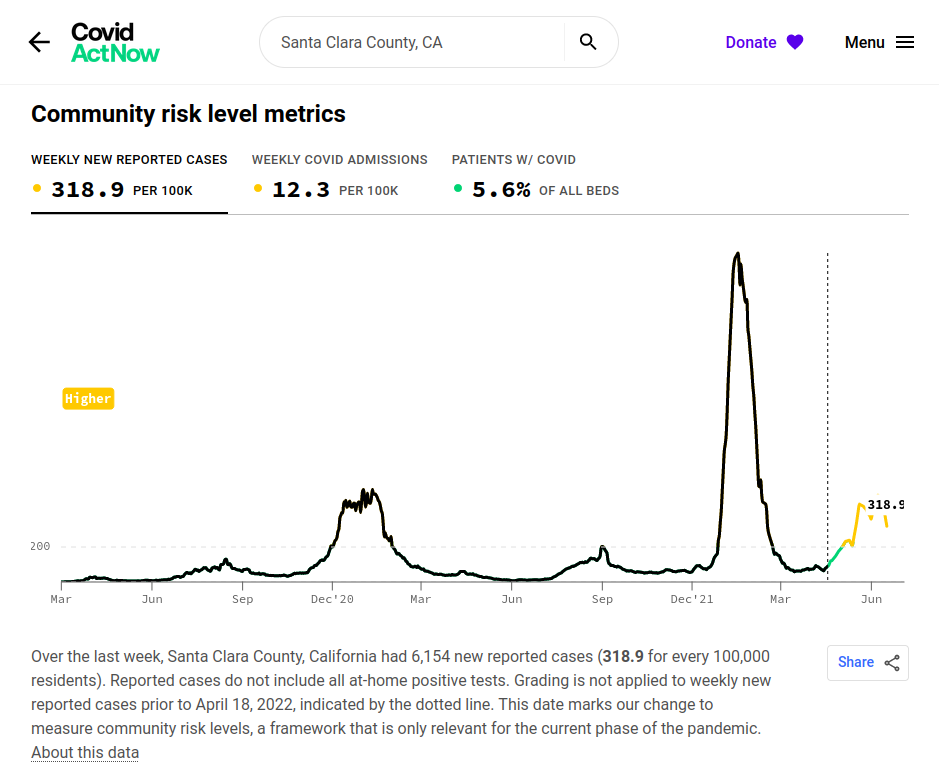

June 19, 2022 (Emancipation Day): The Pandemic may have passed into the Endemic phase here in the USA., but it’s definitely not over in countries like China, North Korea, and Russia – anywhere with inferior vaccines, or complete lack of them. I hear very little about Covid in the news, locally. Most people are still masking in stores in my area. On the street, about 50% of people are masking, but we’re probably at a higher rate than most of the country.

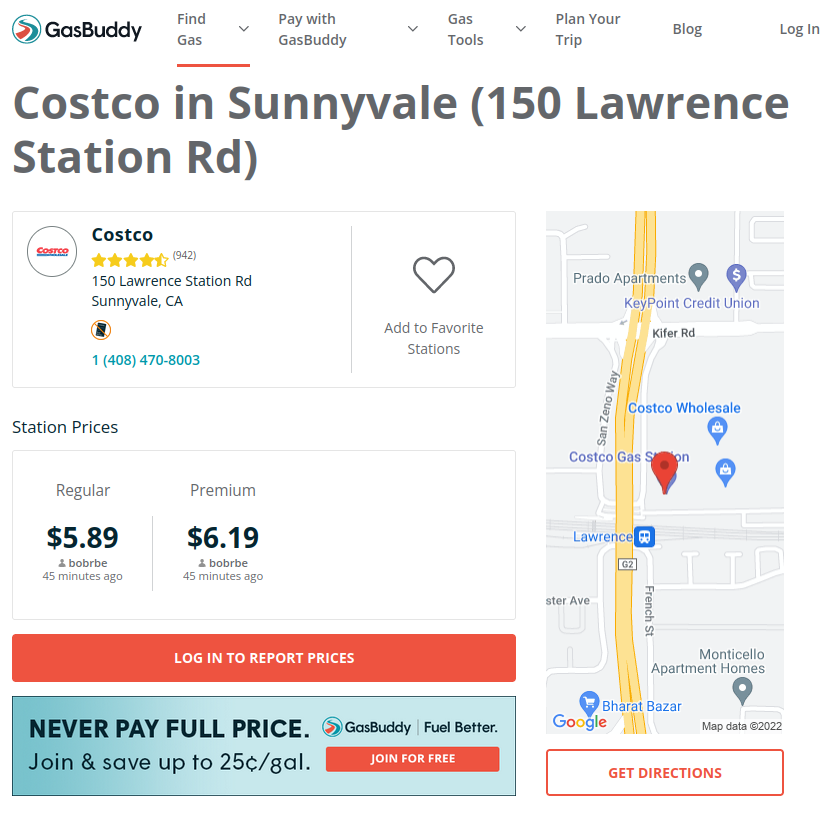

At this writing, the inflation rate is high. Not 1970’s high, but the recent annual rate seems to be about 6.7%, after decades of hovering around 3% or less. I’m not surprised. The government injected a lot of money supply during the pandemic to protect the economy – which I believe was the right thing to do given the actual emergency – but now it’s time to pay the price. The Dollar Tree is now $1.25. Restaurant meals seem to be up 25% or so at least, except on the low end, where they’re still up, but not as much, as fast food struggles to find workers willing to work for minimum wage and no benefits. Grocery prices are up significantly. I recently heard that the price of Energy was up 50% year-over-year. None of this has direct material impact on my personal family, but for those at low income and asset levels, it’s brutal.

One final learning from recent times. If inflation is coming, stock up on quality socks and underwear. They keep indefinitely without refrigeration, don’t take up a lot of space, and eventually, you’ll be able to use them.

Update, 13-JUL-2023: We went to Hawaii for a few weeks. Flying over and back, very few people were masked. In Hawaii, like our home in California, few people were masked anywhere. We attended an indoor family gathering on July 9th with 14 people. One of the people was not feeling well on the way home from that. As of today, 5 of the people there got COVID-19, and it has been debilitating for them. 4 of the people were in their 60’s, and one was 59. The 3 of my immediate family all have tested negative.